|

|

|

|

|

|

|

|

|

|

||

|

|

||

|

|

|

|

|

|

PLANNER COMMENTS

![]()

For marketing and promotional ideas, visit www.impactcommunications.org.

![]()

"Lee Eisenberg's book is terrific. I interviewed Lee for "Finding the Number", an article I wrote for Financial Advisor magazine, and have recommended the book to many friends and advisers. While you might just write off the book as another pop-psychology-of-money phenomenon, this would be a big mistake. THE NUMBER is a potentially ground-breaking record of many of the ways people will fail in retirement."

David Drucker, MBA, CFP (r)

Drucker Knowledge Systems

www.daviddrucker.com

![]()

“The main value from The Number isn't in the answers it provides, but in the questions it raises. Every baby boomer should read this book as a start to the retirement thinking process. The Number helps frame necessary discussions in a meaningful way. I’ll be adding it to my Web site and recommended reading lists."

» Listen to Dan’s audio book review now.

Dan Danford, Fee-Only Investment Manager

Family Investment Center, LLC

www.familyinvestmentcenter.com

![]()

“My company formed a book club a while back. One of the books we read and discussed is Lee Eisenberg’s The Number. We enjoyed discussing the book’s key concepts, as a group. Lee raises the question, ‘Could it be the reason that we don't plan is because we don't have anything meaningful to plan for?’ in the book. Working with our clients on this topic is one of the central tenets of our firm. We found The Number dealt with this issue more clearly (and more enjoyably) than anything else we have encountered."

Ross Levin, CFP®

Accredited Investors, Inc.

www.accredited.com

![]()

“I received THE NUMBER book yesterday at my office, and earnestly delved into it last evening after supper. As of two a.m., I sat and grappled with both wonder and bewilderment. You have conveyed a remarkable tale to your readership, and for that I thank you. Your book is now my "number one" financial and behavioral book, and the essence of it both soothes and terrifies me. As one who has chosen planning as my profession, I plan to impart your ideas to my clients and, at the same time, re-examine my goals and my life – earnestly seeking to quantify "My Number" and the direction I wish my life to take. Thank you!”

Grant F. Strand, CLU, ChFC, CFP®

Kofin Financial Group / Alberta Canada

www.kofin.ab.ca

![]()

“When I first saw The Number book my local Barnes and Noble, I glanced at it and thought, great, another book that espouses a one-size-fits-all approach so they will feel good about their financial future. Then last week, while sitting down with a CPA's client, I was in the process of explaining my firm's valued proposition when the wife suddenly said, 'Oh, you will help us find our Number, like the book.' She went on to explain that reading this book prompted her to ask their CPA for an independent advisor who could assist them, hence the appointment with me. If that is the power of this book, seems like financial advisors (me included) should be giving this book to prospective clients before they even sit down to get acquainted. It will make the process a whole lot easier.”

Brent E. Bentrim, Certified Estate Advisor

Carolopolis Family Wealth Management, Inc.

www.carolopolis.net

![]()

“As a CFP, Financial Educator and a recent entry in the BIG 5-0 Club, I devour every book I can find on retirement planning. Most of them put me to sleep before I am halfway through the book...... EXCEPT YOURS! Congratulations on writing a financial book that not only deals with the Big Issues that most individuals aren't even contemplating but also writing a financial book that is actually witty and engaging! As I am sure you have learned over the past few years, most individuals in the financial planning profession take life and themselves very seriously. And the books they write mirror that seriousness. So, The Number stands out like a breath of fresh air. I know it will be a big hit!

Linda Schoenfeld, CFP®

Charlotte, NC

![]()

“ I can tell you where I was and what I was doing when I heard about The Number. The following Thursday, my wife and I listened to The Number all 650 miles from our home in Greensboro, NC to our daughter and son-in-law's home in Jackson, TN. In the last six weeks, I've read everything people were saying about the Number. I found Scott Dauenhauer and read all about him and the Secrets of the Wirehouse. I found George Kinder and read all about him. I went back and listened to some of my client meetings to see how well I listened to them. I think my breathing could use improvement. Not only is The Number is the biggest change I've seen in 30 years in this business, it's a delightful book to read, and to listen to. In fact, I think The Number is a 10 times change. I told my partners, ‘This book can literally change the future, if folks will let it.’ I know it can literally change the future for good, for the clients and stake-holders of Jonathan Smith & Co. Investment Counsel. I've never seen or heard anything like it. I even wonder if I should change our name to ‘It's about more than money.’"

Jonathan Smith, Principal

Jonathan Smith & Co.

www.jonathansmith.com

![]()

“I have a fee-based financial planning firm in Chattanooga, TN and have been doing a daily radio show for 9 years on financial matters. To say the least your book is wonderful. I have recommended it to all who will listen.”

Jim Place, CFP®

Evergreen Advisors

www.evergreenadvisors.com

![]()

“One aspect of the book that I found interesting is his analysis of why people fail to plan. Why is so little consideration given to the future and what has caused the tremendous drop in personal savings rate and the great emphasis on consumption and the ‘here and now?’ Eisenberg excludes the big obstacles - fear of death and fear of global annihilation - and lists six items that he calls The Eisenberg Uncertainty Principles. As a planner, the first thing that occurs to me is that planning is one powerful method to deal with uncertainty - by counting on it. You may have heard the _expression ‘Man plans; God laughs!’ This certainly implies that things will not turn out as anticipated, but if you consider a plan as a track to run on, you have a place to return to to adjust your journey. Frankly, the job of a planner is not to make decisions for a client, but to provide the client with the information he or she needs to make intelligent, informed decisions with an understanding of the trade-offs involved in any course of action.” Read full book review now.

Fred A. Forbes, MBA, CFP® CSA

Palmetto, FL

![]()

“I just wanted to let you know I recently read you book and think it is super. I have purchase several copies of your book as I hand them out at all my seminars in attempts to get people thinking about ‘The Number’ and, more importantly, why it is truly important to them.”

Ted Thomsen

Wangard Advisors, LLC

www.wangardadvisors.com

![]()

THE NUMBER struck a chord with me from the very beginning as a compelling, engaging discussion of the “big picture” aspect of financial planning. Eisenberg’s take on financial planning is remarkably similar to the discussions we’ve been having with our clients at JNBA for the past 25 years. He captures the importance of taking a detailed look at not only how much money you’ll need in retirement, but why.

This spring, we built a successful public event around the topics he raises in the book, which allowed our clients and other Minnesota investors to enter into an in-depth discussion about their futures. Our hope is that by introducing more people in the Twin Cities to the thought-provoking questions The Number raises, they’ll be able to make confident, smarter decisions about their money — and their lives.

Richard Brown

CEO, JNBA Financial Advisors

Bloomington, MN

www.jnba.com

![]()

“Needless to say with my name and business profession (yes I know, I spell it differently) I have been getting a lot of comments from my friends and clients asking me if I wrote this book. I even tried to fool my mother by showing her the book, but she is smarter than I thought and opened the back cover to look at the picture! Retirement Planning and Wealth to Income Strategies are a big part of my practice and I enjoyed the book a great deal.”

Lee C. Eisinberg

Financial Consultant

Phoenix, AZ

![]()

“I'm a CPA and wealth advisor, so I was intrigued by the book title and the subject matter. This is not "Financial Planning for Dummies." The author assumes you have a Number or the hopes for a Number. If you have no wealth, aspirations for wealth, or hope of wealth, this book won't magically create it. The author is very entertaining and has many interesting stories and examples. The book will help you rethink your number and the whole concept of retirement or ‘the new rest of your life.’ For other professionals who offer wealth advice, I'd recommend this book simply for ideas to help your clients talk about their Number.”

Sherman L. Doll, CPA/PFS

Walnut Creek, CA

![]()

"Congratulations! Finally a book from someone without 'alphabet soup' behind their name that gets to the heart of the heart. For a long time I have been coaching clients that they must be prepared to retire to something rather than from something, and that their values must be consistent with their value. I will be distributing this book to most of my client base — I just ordered another 25 copies! My wife, a 'Prober,' really enjoyed the book as well."

Michael R. Burgoyne CFP ChFC

Laurus Wealth Management

www.mburgoyne.com

![]()

“I just finished reading The Number and wish to applaud Lee Eisenberg. It kept me reading from cover to cover. The author takes readers on a journey without overloading us with numerical overload. I have written three financial planning books myself, and picked up this book in response to a friend's request to help him figure out his Number. I found Eisenberg’s work so insightful that I purchased three more books for friends in various stages of life. Thank you for writing such an interesting book.”

Bruce McWilliams

Author of Penny Stocks, Bruce McWilliams’ Under-33 Financial Plan

and the Financial Times’ Picking the Right Mutual Fund

![]()

“THE NUMBER is a chronicle of the difficult issues many people face in answering ‘How much money will I need to retire?’ Eisenberg's skills as a journalist give the book a kind of edginess that keeps it interesting, and his approach as an active but initially uninformed seeker for his number keeps it practical. I have already written a book review for my newspaper column and plan to do a follow up article as well. I will also recommend it to clients, prospects and anyone else who’s serious about planning for the ‘rest of their lives.’”

Bruce E. Brinkman , CFP®

Timothy Financial Counsel Inc.

www.timothyfinancial.com

![]()

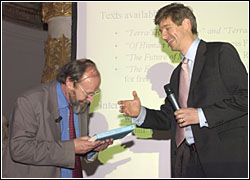

“In January, I was pleased to present a copy of THE NUMBER to Bernard Lietaer during a meeting with 150 leaders within the Dutch financial service Industry. The national newspaper, De Volkskrant, was also there. Mr. Lietaer is an economist and author of nine books. He was one of the designers of the Euro and has been active in the domain of money systems for over 25 years in a wide variety of functions, including serving as President of Belgium’s Electronic Payment System.”

“In January, I was pleased to present a copy of THE NUMBER to Bernard Lietaer during a meeting with 150 leaders within the Dutch financial service Industry. The national newspaper, De Volkskrant, was also there. Mr. Lietaer is an economist and author of nine books. He was one of the designers of the Euro and has been active in the domain of money systems for over 25 years in a wide variety of functions, including serving as President of Belgium’s Electronic Payment System.”

Ivo Valkenburg

Adviesklimaat, The Netherlands

www.adviesklimaat.nl

![]()

“Serious financial planning is all about asking the right questions. This book will help planners do a better job working with and serving their clients. I'm going to write a review of the book for my next newsletter."

Steven R. Smith, JD, CFP®

RightPath™ Investments & Financial Planning, Inc.

www.rightpathinvestments.com

» Read Steven's book review now.

![]()

“Here’s what made The Number book so interesting to me. I have read dozens of how-to financial planning books related to asset accumulation, goal-setting, life expectancy, estate planning, and so forth. Eisenberg’s is the first book I have run across that looks at the more spiritual or human side of wealth accumulation and planning. And ‘the Number, Quick and Dirty’ formula (provided specifically for the book by financial Life Planning guru George Kinder, a long-time CFP) – despite the rule-of-thumb nature of the title – is actually quite elegant and comprehensive. I have submitted a book review [MS2] to my local newspapers and broadcast media. This information is too good not to share!”

Dr. Jason T. White

Assistant Professor of finance and economics

Northwest Missouri State University

www.FamilyInvestmentCenter.com

![]()

“I am thoroughly enjoying THE NUMBER (about halfway through so far), and I am considering recommending it in a brief e-mail to clients, prospects and other interested parties, for an Oak Brook-based wealth management and advisory firm for which I do public relations. I will also be watching for Chicago-area book talks that Lee may be giving."

Matt Baron

MB Communications

www.mattbaron.com

![]()

“I have never read a book on our industry that is as comprehensive, clever and hilarious as Lee Eisenberg's THE NUMBER. It is rare to find an author who can take a financial topic and turn it into fact-filled reading entertainment! I love this book and plan to use THE NUMBER's key concepts to generate better conversations with my clients."

A Wealth Manager at one of the nation's largest brokerage firms

Private Client Division (name withheld due to policy)

![]()

"I was recently contacted by a husband and wife who'd read Lee Eisenberg's book and wanted to become a Life Planning client. They found the book 'enlightening, scary and informative' -- and realized that they could use the help of a professional planner 'for both the financial end and the life planning perspective.' Then a long lost friend from college called me up and invited me to talk about THE NUMBER to his friends in a book club -- he is going to recommend the book to them and what great exposure for me. I mention the book to almost everyone I come across as good reading, and I carry around a copy to stimulate discussions when I'm out and about. THE NUMBER is a great tool for financial advisors!"

Steven S. Shagrin, JD, CFP®, CRPC®, CRC®, CELP

President, Planning For Life

www.PlanningforLife.info

![]()

"Retirement planning is one of the biggest issues the baby boom generation is facing today. In the book THE NUMBER, Lee Eisenberg presents boomers with a different approach to this issue. If you are helping your clients plan for retirement or get through it with ease, this book provides a well rounded view from a quantitative as well as a qualitative perspective of what they -- and you -- should be thinking about. I recommend reading it. In fact, I wrote a book review for the Financial Sense column on Maine Today. I plan to use the book to stimulate better conversations with my clients, prospect within the community, etc."

Jeff Boque, CFP®

Bogue Asset Management , LLC

www.bogueassetmanagement.com

![]()